Letter of Credit (LC)

Summary

What is Letter of Credit (LC) ?

Written By

Sudeep Dalal

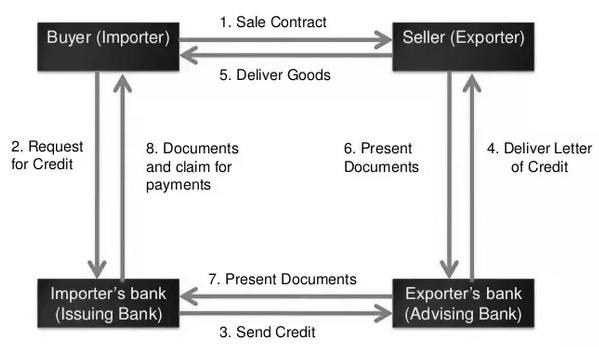

A Letter of Credit (LC) is a financial document provided by a bank that guarantees a buyer's payment to a seller will be received on time and for the correct amount.

Here are the main types:-

1. Revocable Letter of Credit

Description: Can be modified or cancelled by the issuing bank at any time without prior notice to the beneficiary.

Use Case: Rarely used due to the lack of security for the seller.

2. Irrevocable Letter of Credit

Description: Cannot be changed or canceled without the agreement of all parties involved.

Use Case: Commonly used in international trade as it offers greater security to the seller.

3. Confirmed Letter of Credit

Description: A second bank (confirming bank) adds its guarantee to the LC issued by the original bank (issuing bank), ensuring payment will be made.

Use Case: Used when the seller requires additional security, particularly if the issuing bank is in a country with higher political or economic risk.

4. Unconfirmed Letter of Credit

Description: Only the issuing bank guarantees the payment.

Use Case: Used when the seller trusts the issuing bank or when dealing with low-risk transactions.

5. Standby Letter of Credit (SBLC)

Description: Acts as a secondary payment method; only drawn upon if the buyer fails to fulfill their payment obligations.

Use Case: Used as a safety net in various commercial contracts.

6. Revolving Letter of Credit

Description: Automatically renews or replenishes after each use up to a certain limit and period.

Use Case: Used in transactions involving regular shipments of goods.

7. Transferable Letter of Credit

Description: Allows the beneficiary to transfer part or all of the credit to another party.

Use Case: Used when the beneficiary is a middleman who needs to pay suppliers.

8. Back-to-Back Letter of Credit

Description: Involves two LCs where one is used as collateral for the other.

Use Case: Used in complex trade transactions involving intermediaries.

9. Red Clause Letter of Credit

Description: Allows the beneficiary to receive an advance payment before shipping goods.

Use Case: Used to provide working capital to the seller for purchasing raw materials or processing goods.

10. Green Clause Letter of Credit

Description: Similar to the red clause but also allows for advance payments to cover warehousing and other pre-shipment expenses.

Use Case: Used when the seller needs funds for pre-shipment costs.

11. Deferred Payment Letter of Credit

Description: Payment is made at a future date after presentation of the required documents.

Use Case: Used in situations where the buyer needs time to sell the goods and generate funds.

12. Sight Letter of Credit

•Description: Payment is made upon presentation and verification of the required documents.

Use Case: Used for transactions where immediate payment is required.